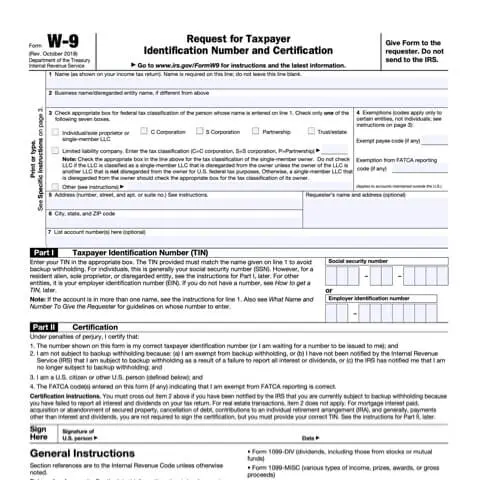

When you’re juggling deadlines, clients, and the daily hustle of your professional life, the last thing you want to worry about is a pile of IRS forms. Yet Form W-9—officially the “Request for Taxpayer Identification Number and Certification”—is one of those unavoidable administrative tasks for freelancers, contractors, small businesses, and even landlords. The good news? Modern digital W-9 form fillers have turned this chore into a quick, secure, and surprisingly painless process. Here’s how embracing a human-focused, online W-9 solution can save you time, reduce anxiety, and keep your finances in perfect order.

Why We All Dread the Paper W-9

Think back to the last time you downloaded a PDF, printed it out, painstakingly filled in every box by hand, wondered whether your handwriting was legible enough, signed in blue ink (or was it black?), then found your scanner, only to discover the file quality was so poor that the requesting party asked you to do it all again. It feels like a relic of the analog era—especially when you’re used to clicking “Send” for invoices, contracts, and even client welcome packets.

Too often, this manual method leads to:

Lost Time: Every minute spent printing, signing, and scanning is a minute away from billable work or family time.

Human Error: A mistyped Taxpayer Identification Number (TIN) or a forgotten signature can trigger backup withholding (24% of your payment withheld!) or late 1099 filings.

Stress & Confusion: What if your printer runs out of ink—or worse, jams? What if the scanned PDF looks blurry?

These frustrations are exactly why digital W-9 form fillers exist: to replace paper-based headaches with an intuitive, end-to-end online experience.

A Warm Welcome to the Digital W-9 Era

Imagine clicking a link, filling in a smart form that asks only what it truly needs, tapping your finger to “sign” electronically, and immediately downloading a crisp, IRS-approved PDF. No printer. No scanner. No uncertainty. That’s digital W-9 in a nutshell—and it’s designed with real people in mind.

Here’s the step-by-step, human-centered journey:

Effortless Start

You land on a clean, friendly interface. Fields are clearly labeled: “Legal Name,” “Business Name (if applicable),” “TIN (SSN or EIN),” and so on. If you slip up—say, accidentally swap two digits in your SSN—the form gently nudges you to double-check before moving on.Guided Clarity

You’ll find brief, plain-English explanations tucked under each section. For example, on “Federal Tax Classification,” a tooltip might read:“Are you a sole proprietor or an LLC? Click here to see how ‘tax classification’ applies to your business.”

Electronic Signature—Seriously Easy

Rather than wrestling with pens and paper, you draw or type your signature in a dedicated box. It’s legally binding, just like ink on paper.Instant PDF Generation

With one final review, you hit “Download.” Voilà: a professional-grade PDF, perfectly formatted to IRS standards, lands in your Downloads folder. You’re ready to share it via email, secure portal, or any channel your client prefers.

Real Benefits You’ll Notice From Day One

1. Time Back in Your Pocket

No more printing, signing, scanning, or re-doing. Filling out a W-9 online takes less than five minutes—even if it’s your first time.

2. Peace of Mind with Accuracy

Built-in checks catch data mismatches and missing information. You can trust that the form you send is complete and correct, avoiding IRS snafus or payment roadblocks.

3. Rock-Solid Security

Top-tier encryption protects your sensitive details from the moment you type them until you safely download your PDF. Plus, reputable platforms don’t retain your data once you close your session—your SSN or EIN isn’t quietly stored on a forgotten server.

4. Scalability for Busy Teams

If you’re a solo professional, one form at a time is a breeze. If you’re part of a finance team onboarding dozens of contractors, look for features like bulk-upload, automated reminders, and a dashboard to track outstanding W-9 requests—features many digital fillers offer.

Bringing the Human Touch to Compliance

What makes a digital W-9 experience truly stand out is its warmth and clarity. Rather than encountering dense IRS jargon, users appreciate:

Friendly Guidance: Short, conversational notes that explain “why” behind each field.

Error-Friendly Design: Clearly highlighted omissions or typos, with suggestions—not just red “X” marks.

Device Flexibility: A mobile-responsive layout means you can complete your form on your phone while waiting for that coffee, or on your laptop at your favorite coworking space.

At the end of the day, technology is at its best when it understands that a form isn’t just pixels on a screen—it’s a chore that used to bring stress. By treating users as real people, digital W-9 platforms turn a once-dreaded task into a five-minute checkmark on your to-do list.

Best Practices to Maximize Your Digital W-9 Workflow

Automate Reminders: If you regularly onboard new contractors, set up an automated email with your W-9 link to fire off as soon as an agreement is signed.

Update Proactively: Any change to your business name, address, or tax classification? Run through the form again and send an updated PDF—no messy handwritten corrections.

Local Archive: Even if your form filler doesn’t store data, maintain your own encrypted folder of completed W-9s, organized by vendor or date, so you’re audit-ready.

Quick Help Resources: Keep a link to a one-page, friendly “How to Fill Out the W-9” guide in your internal docs, so even new team members or vendors can breeze through the process.

Conclusion: Compliance with a Human Touch

Switching to a digital W-9 form filler isn’t just about embracing new technology—it’s about reclaiming your time and reducing stress. When systems are designed thoughtfully, respecting the human side of compliance, we all benefit. You get accuracy, security, and speed; your clients or vendors get a seamless experience; and your finance teams get reliable data without the back-and-forth.

So next time you—or someone on your team—needs to submit a W-9, skip the printer. Click the link, fill in those friendly fields, sign with a tap, and download your polished PDF. Compliance has never felt so effortless—or so human.